2025 Trends Report by The New Consumer & Coefficient Capital

As we move into 2025, the consumer landscape is undergoing significant shifts, driven by evolving technology, post-pandemic behaviors, and a growing focus on health, convenience, and affordability. The New Consumer and Coefficient Capital have put together a 2025 report on the potential trends for next year. These trends are shaping the industries we’re investing in, confirming that our strategic analysis and due diligence in identifying promising sectors for the new year are on target.

E-Commerce Resurgence

While e-commerce saw an initial boom during the pandemic, it has since stabilized and continues to show strong growth. As of late 2024, e-commerce accounts for 16.2% of total retail sales in the U.S., a figure that has more than doubled over the past five years, reaching $1.16 trillion. TikTok Shop has emerged as a formidable player, showing impressive 156% year-over-year growth, and challenging established e-commerce giants like Shein and Sephora. Over 50% of TikTok users have made purchases, reflecting solid consumer retention and satisfaction. While traditional e-commerce leaders like Amazon and Walmart still dominate, platforms like TikTok Shop (215% growth) and Whatnot (97% growth) are quickly gaining ground.

Callais Capital Investments in E-Commerce:

- Something Borrowed Blooms: Specializing in renting high-quality, artificial wedding flowers, Something Borrowed Blooms offers an affordable, sustainable alternative to buying fresh flowers. Their customizable silk floral arrangements mimic real flowers, reducing waste while helping couples save money on their special day.

- Society Brands: This e-commerce powerhouse acquires, scales, and optimizes direct-to-consumer (DTC) brands across various sectors. Society Brands focuses on enhancing operations, marketing, and product development to maximize growth while preserving each brand’s core values.

Online Grocery Growth

Online grocery shopping, once expected to plateau post-pandemic, continues to gain momentum, with sales up 28% year-over-year in 2024. Despite the initial surge having subsided, consumers continue to embrace the convenience of online grocery shopping, often splitting their purchases between online and traditional stores.

Callais Capital Investments in Grocery:

- Circle the Wagons (CTW): Circle The Wagons (CTW) is a Group Purchasing Organization that boosts independent grocers’ profitability by offering collective buying power, shrink management, training, and innovative retail solutions, enhancing operational efficiency and helping businesses stay competitive.

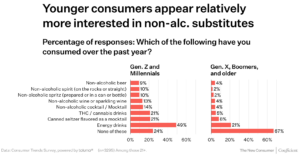

Alcohol and Non-Alcohol Trends

While alcohol consumption remains stable, younger, health-conscious consumers are increasingly exploring non-alcoholic alternatives such as mocktails and THC-infused beverages. The rise of “Dry January” and the popularity of non-alcoholic substitutes, like water and soda, reflect a cultural shift toward wellness and moderation.

Callais Capital Investments in Non-Alcoholic Products:

- Allways Drink Drops: Offering concentrated, portable liquid drops, Allways transforms ordinary water into flavorful, health-boosting drinks. With an emphasis on natural ingredients, Allways provides a healthier alternative to sugary beverages while supporting hydration and wellness.

- EarlyBird (Society Brands): Known for its health-focused powdered drink mixes, EarlyBird supports energy, focus, and overall wellness. Packed with natural ingredients like vitamins and adaptogens, EarlyBird provides a clean, sustained energy boost, making it a healthier alternative to traditional energy drinks and coffee.

Health and Nutrition

Consumers are prioritizing health-conscious eating, focusing on protein and fiber-rich foods, with an increasing awareness of the need to avoid ultra-processed products. However, many struggle to fully understand the definitions of processed foods, prompting calls for clearer labeling and more regulation. Fun trends, such as pickled cotton candy, are also emerging, indicating an appetite for both health-conscious and indulgent foods.

Callais Capital Investments in Health and Nutrition:

- Vitality Now (Society Brands): Vitality Now offers a range of dietary supplements and wellness products, designed to improve energy, immunity, and overall health. By using high-quality, natural ingredients, Vitality Now empowers customers to take control of their well-being through science-backed supplements that support both physical and mental health.

Economic Outlook

Despite perceptions of a recession, the U.S. economy is not in a downturn. However, many Americans still feel the effects of inflation and income inequality. While top earners have seen significant financial gains, the majority of Americans are struggling with rising food prices, which have increased by over 20% since 2020.

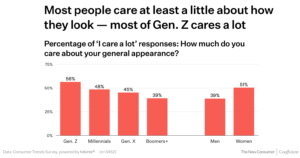

Beauty and Personal Care

Gen Z is now the dominant force in the beauty market, with their preferences shaped by loyalty to specific brands and an openness to new trends. TikTok continues to influence beauty standards, with affordability and innovation being key factors in their buying decisions. Gen Z, in particular, is gravitating toward face and lip care products and values their appearance.

Callais Capital Investments in Beauty and Personal Care:

- Beast Brands: Beast Brands provides high-performance grooming products for men, with a focus on natural ingredients and masculine scents. Their range includes hair care, beard grooming, and skin care products, designed for simplicity and high-quality results.

- Primal Life Organics (Society Brands): Specializing in natural, organic personal care products, Primal Life Organics offers skincare, oral care, and body care items free from harmful chemicals. By promoting sustainability and wellness, the brand combines modern skincare needs with eco-friendly practices.

Consumer Sentiment and Future Outlook

Despite economic uncertainty, life satisfaction among Americans has slightly increased, though concerns about rising prices and income inequality persist. The resilience of consumer spending was evident during the holiday season, with record e-commerce sales, showing strong confidence in the face of economic challenges. As we move forward, brands that prioritize digital engagement, health-conscious products, and transparency will be best positioned for success. Emerging platforms like TikTok Shop offer exciting growth opportunities, but addressing inflationary pressures and economic disparities will be critical in maintaining consumer trust and confidence.

Looking ahead, our investments are well-positioned to align with the consumer trends shaping 2025. By focusing on high-potential industries and diversifying our portfolio, we remain confident in our ability to drive long-term growth in the evolving market.